Introduction

Learn how to create a PayPal business account work for your small business, from setting up your account to figuring out fees.

PayPal is a typical way for individuals to get compensated for selling labor and products. It’s not difficult to utilize, and safe, and there are no charges to set it up. Even though you can in any case send and get cash with an individual PayPal account, utilizing a business account has a few additional advantages.

There are a ton of ways of coordinating installments and Online business, for example, by assuming praise card installments or utilizing applications for portable installments. PayPal likewise has incredible client support and a spot to tackle issues. This allows you rapidly to fix any issues at checkout or discuss alternate ways of handling installments.

You can likewise deal with exchanges with different nations, block installments, and make charging data. Business PayPal accounts have a greater number of elements and ways of paying than individual PayPal accounts. Here is all the data you want to set up a PayPal business account.

About

What Is A Business PayPal Account?

A PayPal business account is a PayPal account that allows you to acknowledge installments and gives you admittance to highlights like internet invoicing, a virtual terminal, repeating charging, and the sky is the limit from there. It’s simple and fast to set up a PayPal business record, and there are no month-to-month or yearly charges.

What You Need To Setup A PayPal Account For A Business

Before you log into PayPal, you should get the following things together to make setting up your business account quick and easy:

1 . An email address

2 . A business phone number

3 . Your legal business name — your name is fine if your business is a sole proprietorship

4 . The last four digits of your SSN

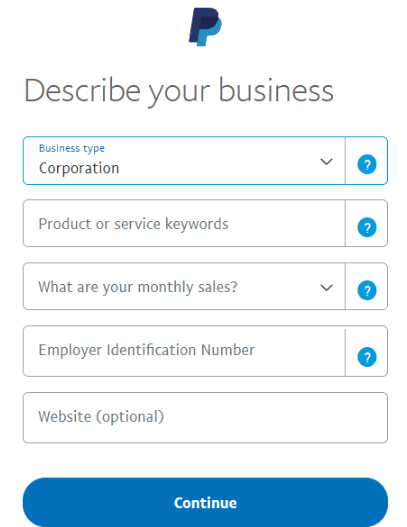

5 . Your Employer Identification Number (EIN) — If you choose individual/sole proprietorship as your business type, you don’t need to provide an EIN

6 . Your date of birth of the business owner who will create the PayPal business account

7 . Your residential address

8 . Your bank name, account number, and routing number

Steps To Setup Your Business PayPal Account

1. Go to PayPal.com and click on Sign Up.

2. Choose Business Account and click Next.

3. Enter your email address. Select an email address that is not tied to a personal PayPal account. If you use an email address that is already connected to a PayPal account, that account will be terminated.

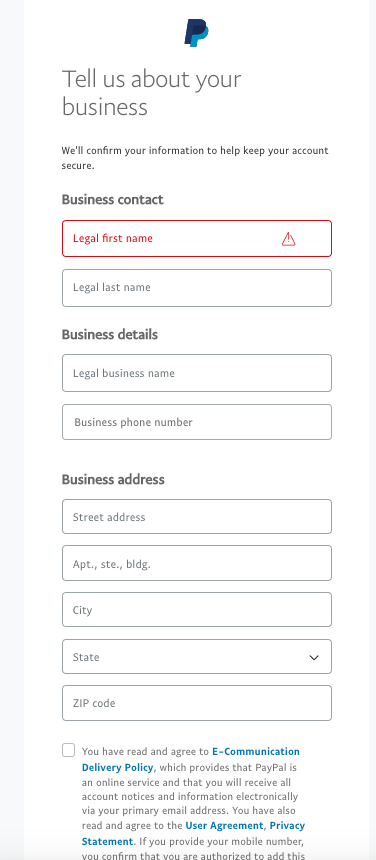

4. Enter some fundamental data about your business, similar to the name of the individual who claims the record, the name and address of the business, your email address, and the name and number of somebody who can assist with client care. Click Concur and Make Record whenever you’ve given all the data requested.

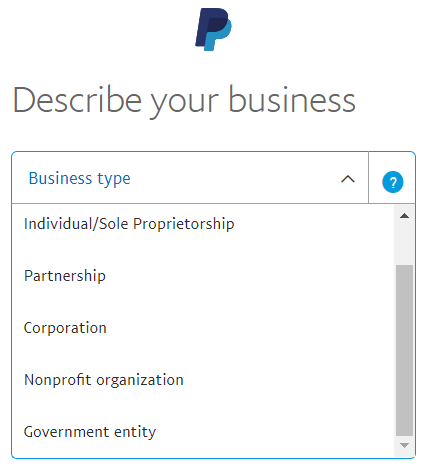

5. Give more data about what your business does. You will be approached to say if your business is a sole ownership, an organization, a partnership, a non-benefit, or an administration office. Contingent upon how you reply, you might get some information about the items or administrations your business offers, recognizable proof numbers, deals, or URLs.

6. Give your contact data. You’ll have to give the last four digits of your government-backed retirement number, your date of birth, and your place of residence to open a record. Whenever you’ve completed this step, click Submit.

7. Verify your email address.

PayPal will send you an email in a couple of moments to affirm the email address you’ve given. Open the email and twofold browse your email address. This step is expected before you can start utilizing your record.

8. Give the subtleties of your ledger. Sign into PayPal and enter your ledger data as coordinated in the email. If you don’t have a business account, you can utilize an individual financial balance number. To finish this step, your bank’s name, account number, and directing number will be requested.

When it is done, PayPal will send a check solicitation to your bank just barely into your record. This cycle requires three to five days, so watch out for your ledger for two little stores from PayPal. At the point when you see the exchange, you can wrap setting up your record.

9. Access your PayPal account.

Extra directions for confirming your financial data might be given. Once finished, PayPal will incite you to choose the installment strategies that your organization will acknowledge. Right now, you’ll approach each of the indifferent highlights of a PayPal business account.

This is sufficient to begin selling, yet when you begin tolerating installments and bringing in cash, PayPal might request more evidence, similar to bank explanations. Outsider processors like PayPal and Square are known for intently watching vendors, which can prompt holds or record terminations at the smallest difficult situation. Be prepared to give PayPal any data they could want.

Benefits of Having a PayPal Account For Your Business

Why should a business get a PayPal account? Let’s look into the reasons why.

Free

Setting up a PayPal business account costs nothing, and neither do the month-to-month or yearly expenses (except if you select to utilize PayPal Installments Progressed or Genius to acknowledge installments).

Access to features for business

If you have a PayPal business account, you can utilize highlights like a virtual terminal, repeating charging, a facilitated checkout page, and invoicing. You can likewise utilize PayPal Here/Zettle to sell things face-to-face with your telephone.

Sell Online Or In Person

Use PayPal for your business and get compensated on the web or face-to-face. Acknowledge credit and charge cards, PayPal, PayPal Credit, and versatile installment applications.

Your Employees Can Use Your Account

Pursue a business account and up to 200 of your workers can utilize your PayPal account. Every representative can have their own login ID and level of power.

Wide Acceptance

On the off chance that you have a PayPal business account, you can interface it with a variety of shopping basket programming. There are numerous POS combinations for stores with actual areas.

Types Of PayPal Business Accounts

When you set up a PayPal business account, you can choose from three different ways to get paid.

1. PayPal Checkout For Businesses

PayPal Checkout is a decent decision if you have any desire to add PayPal as an extra installment choice to your site or on the other hand if you as of now work with a Web-based business supplier. You’ll have PCI consistency (PayPal sends clients to its solid site to complete the exchange), context-oriented checkout buttons, and installment techniques that are limited for clients in Europe.

Pursuing PayPal Checkout is free, and there are no month-to-month charges.

2. PayPal Payment Advanced

PayPal Installments Progressed is a preferable method for paying over PayPal Checkout since it has more highlights. Installments Progressed costs $5 each month and have similar Internet business reconciliations as PayPal Checkout. It additionally allows your clients to pay right on your site. This is finished with the assistance of facilitated checkout layouts. With these layouts, the installment data goes through PayPal’s servers rather than your own, so you don’t need to stress over PCI. You’ll likewise get a lot of additional elements, for example,

Acknowledge credit and check cards (your clients needn’t bother with a PayPal account).

Acknowledge PayPal installments

Send charges online to get compensated rapidly.

You can take installments from 202 nations in 25 distinct monetary standards.

PCI consistency was made simpler.

No arrangement, withdrawal, or undoing expenses. No drawn-out agreements.

PayPal exchanges can be made with a markdown for non-benefits

Help via telephone free of charge

Offer extraordinary installment plans for acquisition of $99 or more

3. PayPal Payments Pro

To utilize PayPal Installments Master, you need to pay $30 each month. It’s for vendors who need full command over the checkout cycle. It’s likewise the main PayPal marketable strategy that gives you a virtual terminal, which you can use without Installments Ace however will in any case cost you $30/month.

With PayPal Payments Pro, you’ll get the following:

- Virtual Terminal

- Accept PayPal payments

- A Payment Gateway

- Accept Visa, Mastercard, and American Express

- PCI compliance easier

- You can take payments from 202 countries in 25 different currencies.

How Much Does It Cost to Have a PayPal Business Account?

You don’t need to pay anything to open a PayPal business account. A PayPal business account is free (except if you pursue the $5/month PayPal Installments Progressed plan or the $30/month Installments Ace arrangement). There is no such thing as free installment handling, and PayPal is no special case. At the point when you make a deal through PayPal, you will be charged installment handling expenses. Tragically, the new evaluating plan executed by PayPal on August 2, 2021, altogether builds the charges paid by little ticket shippers and the individuals who depend on little gifts/tips.

The following are the transaction fees that US-based merchants will pay:

- 3.49% + $0.49 per PayPal Digital Payments (PayPal Checkout, Pay with Venmo, PayPal Credit, Pay in 4, PayPal Pay with Rewards, and Checkout with Crypto) transaction

- 2.99% + $0.49 per online credit/debit transaction with standard card payments

- 2.59% + $0.49 per online credit/debit transaction with advanced card payments (2.99% + $0.49 per transaction if you have Chargeback Protection)

- 2.89% + $0.49 per transaction if you’re on the Payments Advanced (not the same thing as advanced card payments) or Payments Pro plan

- 1.9% + $0.10 for PayPal/Venmo QR code transactions above $10

- 2.4% + $0.05 for PayPal/Venmo QR code transactions $10 and under

- 1.99% + $0.49 per online transaction for nonprofits (check out PayPal For Nonprofits to learn more)

- 3.09% + $0.49 per Virtual Terminal transaction

- 4.99% + $0.09 per transaction under the MicroPayments plan

Recall that the Virtual Terminal costs $30 each month, whether you get it as an independent component or as a feature of Installments Star. Generally speaking, PayPal’s charges are practically identical to those of other outsider processors, however, as recently expressed, Square and Shopify both give a virtual terminal without a month-to-month expense.

One late strategy change that has disturbed merchants is that when an exchange is discounted, PayPal doesn’t discount the handling expense. That implies you’ll lose $3.98 assuming that you discount a $100 online buy to a client (on account of a PayPal Checkout exchange). These expenses can rapidly add up if you are giving an enormous number of discounts. Look at our article on Mastercard discount expenses for more data on discount arrangements in the installment-handling industry.

This article doesn’t cover all PayPal charges. Peruse our article on PayPal estimating for more data on the expenses of card perusers, change expenses, American Express handling charges, and chargeback expenses. If you’re a vendor outside the US, look at PayPal’s full rundown of vendor expenses, because the proper part of your exchange charges (with a 2.59% + $0.49 exchange expense, the decent piece is 49 pennies) will change contingent upon the cash you use.

Differences Between PayPal Business And Personal Account

While choosing a PayPal business account and an individual record, remember that both record types let you send and demand cash, make buys, and even get compensated for deals you make, as long as you mark this business as being for “Labor and products,” which will bring about exchange charges (and PayPal will check to ensure you’re doing whatever it takes not to stay away from exchange expenses by mislabeling exchanges).

However, if you don’t have a business account, you will not have the option to utilize a lot of elements that make business simpler, such as making delivering strategies, following stock, giving workers halfway admittance to your record, and pursuing administrations like PayPal Zettle.

Conclusion

Regardless of some security blemishes, PayPal remains a feasible choice for traders. PayPal functions admirably as a starter choice for new organizations, with basic, straightforward estimating and broad Web-based business incorporations, and will scale with your business as it develops. Moreover, online merchants can constantly involve PayPal as an extra strategy for tolerating installments. This isn’t valid for most of PayPal’s rivals.